-

Managing Multiple Accounts Efficiently with Fintechee Expert Advisors

The Importance of Multi-Account Management in Forex TradingFor professional Forex traders and portfolio managers, managing multiple accounts simultaneously is essential. Each account may follow different strategies, trade different currency pairs, or belong to different clients. Manual monitoring of multiple accounts is time-consuming, prone to error, and can lead to missed trading opportunities. Efficient multi-account management

-

Regulatory Considerations for Financial Spread Betting Platforms

Financial spread betting is a popular leveraged trading product in select markets, particularly in the UK and Ireland. While it shares similarities with CFDs and Forex trading, regulatory requirements for spread betting differ significantly, making compliance a critical consideration for brokers. Fintechee provides a platform that enables brokers to offer spread betting services while meeting

-

Comparing Centralized, Decentralized, and Semi-Decentralized Exchanges

As digital asset markets continue to evolve, different exchange models have emerged to meet varying needs around security, efficiency, and control. Centralized, decentralized, and semi-decentralized exchanges each offer distinct advantages and trade-offs. Understanding these differences is essential for asset owners and institutions seeking the most suitable trading and transfer solutions. Definitions of Exchange Models A

-

Automated Forex Trading and Simulation with Fintechee

Features of Fintechee Automation ToolsFintechee offers a powerful suite of automation tools designed to help brokers provide advanced algorithmic trading capabilities to their clients. The platform supports a wide range of automated trading strategies, including algorithmic execution, conditional orders, and signal-based trading. These tools are fully integrated into the White Label solution, allowing brokers to

-

JavaScript Without Complexity: FiSDK’s Low Learning Curve

In the fast-paced world of trading, ease of use and rapid development are as important as performance. While many trading platforms require developers to work with complex JavaScript frameworks, FiSDK takes a different approach—prioritizing simplicity and accessibility without compromising functionality. Why FiSDK Avoids Complex JS Frameworks Most modern web applications rely on frameworks such as

-

The Role of Gamification in Forex Trading

In the highly competitive Forex and CFD market, attracting traders is only the first step. Sustained engagement and long-term activity are the real drivers of broker profitability. Gamification plays a critical role in addressing this challenge by transforming trading from a purely transactional activity into an interactive experience. Trading competitions, rankings, and performance-based rewards motivate

-

Hub-Centric Architecture: The Backbone of Fintechee Copy Trading

As copy trading platforms scale, architectural choices become a decisive factor in performance, reliability, and long-term growth. Many legacy systems rely on loosely connected peer-to-peer models that struggle under high concurrency and operational complexity. Fintechee takes a different approach by adopting a hub-centric architecture designed specifically for scalable, distributed copy trading. This architecture forms the

-

Copytrading Made Efficient via FIX API

As trading strategies diversify across platforms and asset classes, traditional copytrading systems face increasing limitations. Many solutions remain locked into a single trading platform or rely heavily on plugins, restricting scalability and data transparency. Modern traders and institutions require multi-platform copytrading systems that can aggregate trades, process signals in real time, and provide reliable performance

-

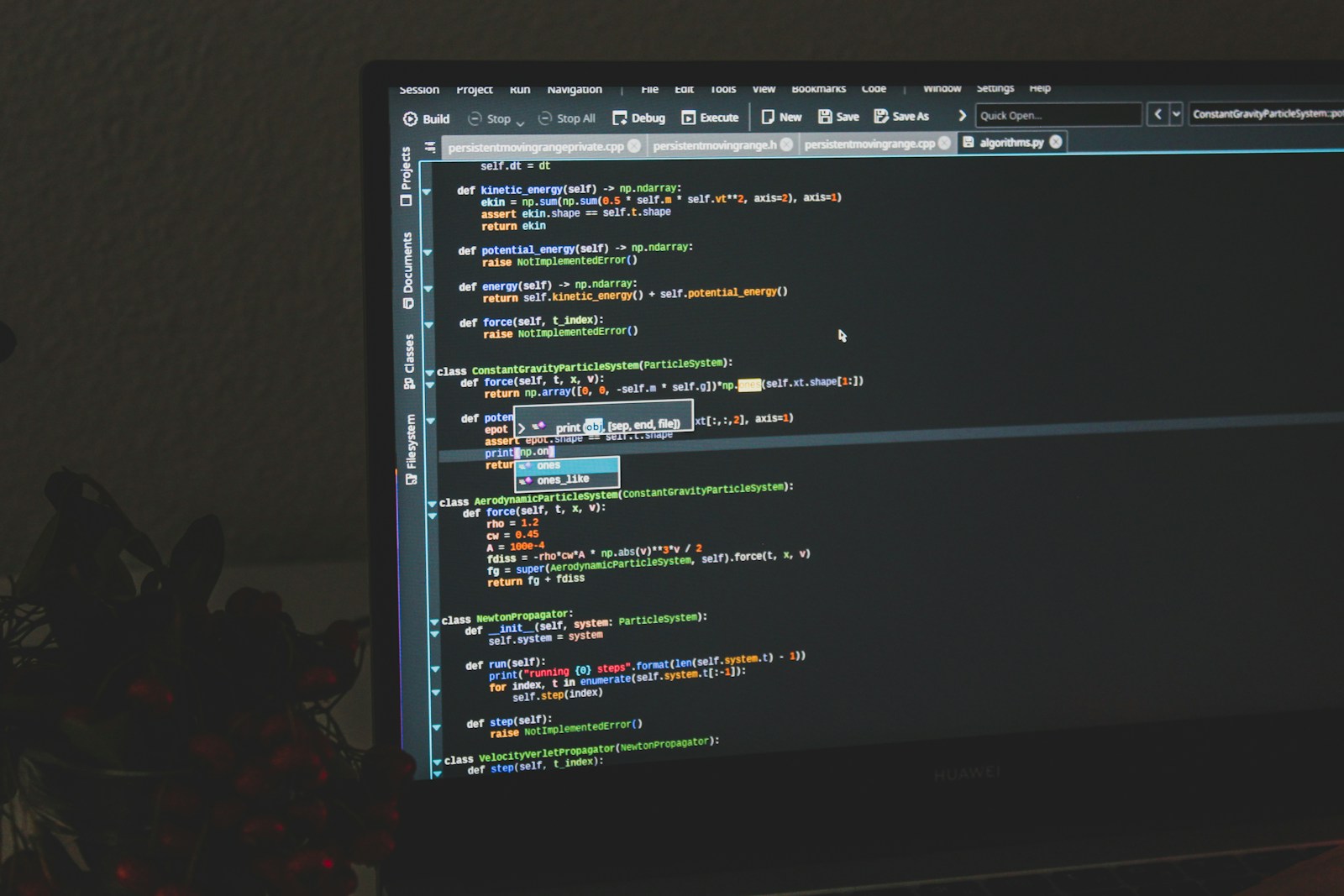

Expert Advisor Studio: More Than Automated Trading

Automated trading has long been associated with running predefined strategies and monitoring performance. However, as markets grow more complex and multi-asset trading becomes the norm, automation alone is no longer sufficient. Fintechee’s Expert Advisor Studio redefines what an automated trading environment can be—evolving it into a complete algorithmic trading ecosystem rather than a simple strategy

-

White Label Trading Platforms for OTC Forex Brokers

Launching and operating an OTC Forex brokerage requires more than market access. It demands reliable trading technology, execution flexibility, regulatory awareness, and the ability to scale efficiently. Fintechee addresses these challenges by offering FIX API-based white label trading platforms designed specifically for OTC Forex brokers. Main White Label vs Sub White Label Structure Fintechee provides

Recent Posts

- Managing Multiple Accounts Efficiently with Fintechee Expert Advisors

- Regulatory Considerations for Financial Spread Betting Platforms

- Comparing Centralized, Decentralized, and Semi-Decentralized Exchanges

- Automated Forex Trading and Simulation with Fintechee

- JavaScript Without Complexity: FiSDK’s Low Learning Curve

Tags

A-Book ai-trader algorithmic strategies algorithmic trading platform automated trading B-Book backtesting portfolio broker compliance broker tools centralized exchange copytrading decentralized exchange digital asset trading distributed trading system event-driven CRM exchange comparison Expert Advisors Expert Advisor Studio financial regulation Fintechee Fintechee FIX API Fintechee multi-account management Forex automation Forex OTC broker HTML JS trading dashboard hub-centric architecture hybrid model JavaScript trading API lightweight frontend no framework required performance analysis platform integration regional licensing scalable copy trading semi-decentralized spread betting regulation strategy testing trade aggregation trader engagement tools trade tracking trading SDK trading signals trading simulation web-trader white label